Aktualności

Wolontariat w Polsce

2025-01-09

The brand new Genius away from Oz Position by KA Gaming: Dive to your the Wonders World

2025-01-09

High school Manga Position from the Wazdan Play Instantly On the internet

2025-01-09

Are Faust by Greentube Totally free Trial & Big Victories Await Heart Gambling enterprise

2025-01-09

Freispiele exklusive Einzahlung 2025 No Abschlagzahlung Slot rainbow riches Free Spins fortschrittlich

Earnings Per Share EPS Formula + Calculator

A cumulative preferred share is sometimes referred to as a guaranteed share because shareholders are ensured of receiving all their dividends. If a company ever has to liquidate, common shareholders are the last group of people who can make claims. The risk of holding common stock in a business is that the general shareholders are the last to be reimbursed or to claim the company’s assets if it goes bankrupt. Some shares may be acquired by public members, whereas others are only available to certain people in the company. In the following sections, we will look at the sorts of stock and earnings per share companies offer.

Do you already work with a financial advisor?

- Bank of America (BAC), for example, is in the financial services sector.

- It is more accurate to use a weighted average number of common shares over the reporting term because the number of shares can change over time.

- By submitting this form, you consent to receive email from Wall Street Prep and agree to our terms of use and privacy policy.

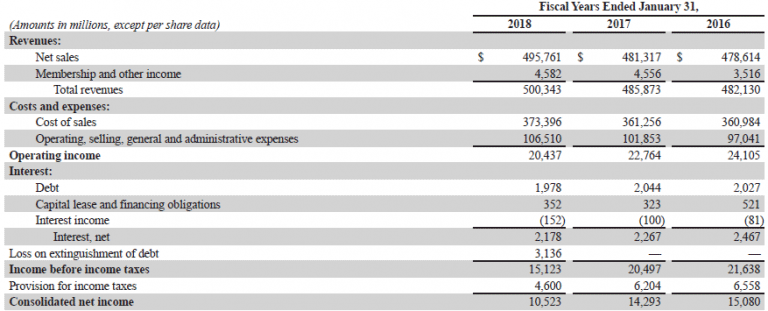

To find EPS, take the company’s net income (and deduct preferred dividends, if applicable) and divide that by the average number of shares of outstanding common stock. Stock price movement is the most significant indicator of future performance. Cash earnings per share are calculated by dividing a firm’s operating cash flow by diluted shares outstanding. To reiterate, the formula for calculating basic EPS involves dividing net income by the weighted average number of common shares outstanding. Basic EPS consists of the company’s net income divided by its outstanding shares. It is the figure most commonly reported in the financial media and is also the simplest definition of EPS.

Why Is Diluted EPS Important?

Comparing EPS in absolute terms may not have much meaning to investors because ordinary shareholders do not have direct access to the earnings. Instead, investors will compare EPS with the share price of the stock to determine the value of earnings and how investors feel about future growth. Notice that the preferred dividend of $50,000 has been subtracted from the income quickbooks online login from continuing operations without impacting the gain on discontinued operations. EPS is an important metric used to assess a company’s profitability from a fundamental perspective. But it’s only one part of the picture for assessing whether a stock is worth buying. Other financial metrics can also give investors a fuller view of the company and its prospects.

Basic vs diluted EPS

It is calculated by dividing the net profit by the outstanding shares of common stock. Basic EPS includes all of the company’s outstanding shares, while diluted EPS includes shares, stock options, warrants, and restricted stock units. To calculate a company’s earnings per share, divide total earnings by the number of outstanding shares.

Because actions like these will effectively increase the number of shares outstanding, they will also dilute the firm’s overall profits when it is evaluated on a per-share basis. Knowing the fully-diluted EPS is therefore important for understanding how current shareholders may be impacted down the road. To calculate a company’s EPS, the balance sheet and income statement are used to find the period-end number of common shares, dividends paid on preferred stock (if any), and the net income or earnings. It is more accurate to use a weighted average number of common shares over the reporting term because the number of shares can change over time. Understanding how to find EPS is crucial for evaluating a company’s profitability. If a company has a complex capital structure where the need to issue additional shares might arise then diluted EPS is considered to be a more precise metric than basic EPS.

Earnings per share is an important metric used by investors and analysts to evaluate a company’s financial performance. It can be calculated using different methodologies, which is important to keep in mind when comparing companies across industries. However, it is also important to look at other types of earnings per share, such as cash, reported, continuous/pro forma, carrying value, and retained EPS, to get a fuller picture of a company’s financial performance.

Conversely, diluted EPS is a metric used in fundamental analysis to gauge a company’s quality of EPS assuming all convertible securities have been exercised. Convertible securities include all outstanding convertible preferred shares, convertible debt, equity options (mainly employer-based options), and warrants. When you’re analyzing an income statement, it’s vital to know the difference between earnings per share (EPS) and diluted earnings per share (diluted EPS). This is a key area for stock investors, because you might end up using the wrong EPS figure.

A higher basic EPS generally indicates greater profitability per share, but it’s essential to consider the context and compare it with industry peers or historical performance for a meaningful assessment. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. There are several types of earnings per share, including cash, reported, continuous/pro forma, carrying value, and retained EPS. Investors should also be aware that companies can sometimes manipulate their reported earnings per share by using accounting techniques such as aggressive revenue recognition or creative expense management. Basic EPS is calculated by dividing a company’s net income by the number of its outstanding shares.

The similarity between a common share and a convertible preferred share that may be converted must first be stated plainly. The dividends of a cumulative preferred share are calculated as follows. Oftentimes, those who hold a preferred cumulative share are given some form of compensation for the unreasonable delay in receiving their dividends. This implies that preferred shareholders do not have the ability to vote for the board of directors or a corporate policy. If a firm goes bankrupt, preferred stockholders receive payment before ordinary stockholders.